|

Newsletter Summary

Currency rates Brewery news Malt news Barley news More news Theoretical malt prices Malting barley prices Table of the week Graph of the week Agenda Do you know e-malt.com?

Average market prices Change trend

Note: Just click on the price link and you will be led to our Market Price History. Average barley market prices are French and are estimated on FOB Creil basis. Average malt market prices are estimated on FOB Antwerp basis. The changes are compared to last Newsletter's prices. Arrows indicate the direction of the change.

Easy E-malt.com

E-malt.com access

Do you know

E-malt.com ?

Dear E-malt Reader!

E-malt.com Links!

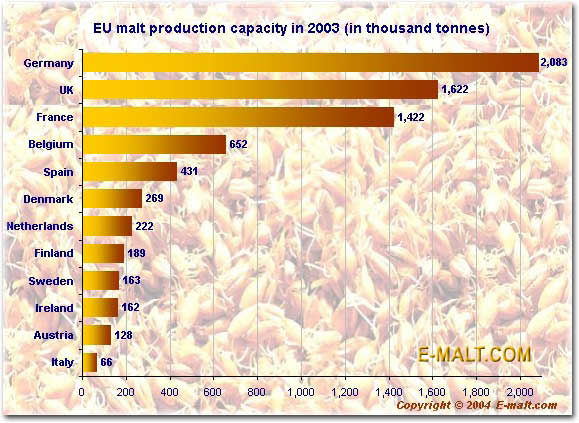

Newsletter 43a, 2004  Newsletter 42b, 2004  Newsletter 42a, 2004  Newsletter 41b, 2004  Newsletter 41a, 2004 The evolution of market prices for barley and malt, which are periodicaly issued with e-malt.com newsletters are published on e-malt.com site in Market Prices section. Just click here! Malt Market Price Evolution. Crop 2004 French Malting Barley Price Evolution. Crop 2004 Malt Market Price Evolution. Crop 2003 French Malting Barley Price Evolution. Crop 2003 All graphs issued with e-malt.com newsletters are published in "Graph" section of e-malt.com site.  Philippines beer production  Denmark malt production and export  World's Major Beer Producers 2003  China barley production and imports  Colombia beer production The graphs are updated from time to time. Just see the updates online on e-malt.com site!  EU malt production capacity  U.S.A. Barley Production  United States Beer Exports  Canada Domestic and Imported Beer Sales  Canada's per capita consumption of beer We have the pleasure to let you know that all e-malt.com tables are published in e-malt.com Statistics section. The Statistics section includes Barley statistics, Malt statistics and Beer statistics. The tables related to barley are published in Barley Statistics section, the tables related to malt in Malt Statistics section and the tables related to beer in Beer Statisctis section. search in statistics  United States Breweries 2004  EU Malting Barley Supply and Demand Estimate 2004/2005  Australia barley crop estimates 2004-2005  Canada: Barley Supply and Disposition 2002-2005  Estimate of EU Barley Crops 2003, 2004 If you have any comments, questions, suggestions or remarks, you can send a mail to: info@e-malt.com. To submit your own news to our editorial team, email to: info@e-malt.com If you have received this newsletter from a colleague, you can obtain your own free subscription here, or a full FREE registration here. You may recommend our site to your friend by clicking here If you do not wish to receive our newsletter, please unsubscribe your e-mail address (@EMAILADDRESS@) from our mailing list using unsubscribe form from our site! | |||||||||||||||||||||||||||||||||

|

E-malt.com Newsletter 43b October 21 - October 24, 2004

Latvia: The Danish Brewery Group (Bryggerigruppen) reinforces its number two position in the Baltic States by acquiring controlling interest in leading Latvian brewery, the company announced on October 20. Bryggerigruppen acquired 83.5% of the share capital of Lacplesa Alus A/S registered in Latvia, the leading Latvian brewery with well-known brand and particularly strong in the HoReCa segment.

The acquisition price of the shares amounts to DKK 8.9 million (EUR 1.2 million), whereas the interest-bearing debt of the company amounts to DKK 19.0 million (EUR 2.5 million) equal to a total value (enterprise value) of some DKK 28 million (EUR 3.7 million). The acquisition, which is subject to, among other things, approval from the Latvian competition authorities, is expected to be completed in early 2005.

Lacplesa Alus A/S is a leading supplier of beer in Latvia with expected revenue of some DKK 45 million (some EUR 6 million) in 2004. The company’s main brand – Lacplesis - is known as a high quality brand placed in the premium segment, and it is particularly strong in the HoReCa area. In addition to its own brands, the company sells and distributes a number of international beer brands in Latvia.

In 2003 the total Latvian beer market reached some 1.5 million hectolitres with Lacplesa Alus A/S holding a share of some 11%, which made it the number 3 beer supplier in Latvia. The company has some 200 employees.

The V8 Strategic Plan of The Danish Brewery Group identifies the Baltic countries as a key target area. In July 2004, the Group announced its acquisition of the leading Baltic soft drinks producer SIA ”Cido Partikas Grupa” registered in Latvia (cf Announcement BG23/2004 of 29 July 2004). This initiative is now complemented by the acquisition of 83.5% of the share capital of Lacplesa Alus A/S.

The Danish Brewery Group now has three breweries and one soft drinks producer in the Baltic countries with expected revenue of DKK 500 million and some 1,000 employees. This clearly makes The Danish Brewery Group one of the leading beverage suppliers in the Baltic countries. In combination with The Danish Brewery Group’s acquisition of SIA ”Cido Partikas Grupa”, which holds a 31% share of the market for fruit juices and soft drinks in Latvia, the acquisition of Lacplesa Alus A/S makes possible the achievement of considerable synergies on sales and distribution. Furthermore, positive results are expected from purchasing and production synergies resulting from cooperation with AB Kalnapilio Tauro grupé in Lithuania. The Danish Brewery Group’s contribution of capital and competence will, based on an overall strong market position, enable further exploitation and enhancement of Lacplesis brand strength...more info

UK: Britain's biggest brewer Scottish & Newcastle announced on October 20 robust performance for the first nine months of the year despite poor summer weather, which dampened beer markets across Western Europe. Since the end of the summer period beer markets have recovered to anticipated levels. This performance is due to improving operational efficiency and good progress from our key brands, the company said. Greater competitiveness across our businesses combined with recovering demand gives us confidence we will meet market expectations for 2004. This robust performance and improving competitiveness positions the group well for further progress in 2005. The UK beer market, as has been widely reported, was relatively weak in the third quarter with poor summer weather compounded by a drop-off in off trade demand following the end of the Euro 2004 football championships. In the context of these testing market conditions, the UK business had a positive third quarter, continuing the strong performance of the first half of the year. The top four beer and cider brands (Foster’s, Kronenbourg 1664, John Smith’s, Strongbow) performed well with volumes for the year to date being +5%; these brands are the key contributors to improving share. This growth has been achieved with no additional discounting, and net sales per hectolitre were slightly ahead for the third quarter. Operationally, the business continues to perform well with high levels of service, good control of costs, and strong cash generation. This improved efficiency is enabling us to invest significantly more in advertising behind our brands; a key driver of improving volumes and margins in the future. As previously indicated, A&P spend will increase by around 1.5% points of net sales for the full year. In France volumes in July and August were, as anticipated, markedly lower than in 2003. As a consequence of the wet summer against extremely tough comparatives we now anticipate the French beer market will decline by around 6% for the full year. However, Brasseries Kronenbourg’s premium brands (Kronenbourg 1664, Grimbergen and Foster’s) continue to gain share (volume –3.5% for the year to date) and total volumes for the third quarter were ahead of those in 2002. Demand has improved since the end of the summer, and for the balance of the year we expect beer market volumes to be at more normal levels...more info Poland, Warsaw: The Heineken group's Zywiec, which has long led the Polish beer market, and long-time runner up SABMiller's Kompania Piwowarska (KP) clashed over third-quarter sales, both claiming to be Poland's largest brewer, Interfax-Europe posted on October 22. "For a long time, we have been closing the gap between us and the Zywiec group, and this quarter we have finally reached the No. 1 place on the Polish market," KP General Director Karl Lippert told reporters on Thursday. "Our market share exceeds 35%, depending on the methodology, and we sold some 320 mln liters" of beer in the third quarter. Heineken's Zywiec replied that it is the market leader, as it currently holds a 37% market share, but it declined to come up with specific sales figures. "We have maintained the 37% market share, but we disclose the volume production data only for the full- and half-year periods," Zywiec President Nico Nusmeier told reporters, claiming the company will strive to take 40% of the market. Kompania Piwowarska boosted third-quarter sales 16.2% to over 320 mln, which gives it a 37.4% share in the country's beer sale total of 855.6 mln liters, as reported by Polish brewers association Browary Polskie. The company aims to sell over 1 bln liters in 2004. The company had a PLN 440 mln net profit in the fiscal year ended in March 2004. Zywiec lifted its net profit by two and half times to PLN 206.2 mln on sales up 8.4% to PLN 3.20 bln in 2003. In volume terms, Zywiec sold some 9.1 mln hectoliters (910 mln liters) in 2003, marking an 8% improvement from the year before. Russia: Baltika, the top Russian brewer, plans to add Iraq and Cuba to its export map next year as it continues to attract new overseas fans. "There are quite a lot of people who like to taste new brands," Baltika Director for Exports Dmitry Kistev said in a telephone interview late on Thursday, October 21, according to Reuters. "They are attracted by the unusual link of 'beer and Russia'," Kistev said of Baltika's typical customer. The St Petersburg-based company, jointly owned by Carslberg and Scottish & Newcastle, plans to raise its export volumes to 180 million litres next year from just 41 million litres in 2001 when it began shipping abroad. "Initially, exports were just the acknowledgment of the quality of our beer," Kistev said. "But when Russian market growth started to slow in 2001, we had to look for new markets." In 2001, export volumes accounted for 1 percent of Baltika's overall sales, but the company hopes to raise that to 6.5 percent this year and 9 percent in 2005. The ultimate goal is to export 15-18 % of production, Kistev said. Russia's biggest beer exporter, which has recently started deliveries to New Zealand, sells the amber liquid in 35 countries. It plans to enter markets in Brazil, Cuba, India and Iraq next year. "We think that military operations will continue next year," he said of Iraq, adding that Baltika hoped mainly to supply coalition forces with its beer. "It will be Baltika No. 9, our strongest beer with 8 percent alcohol content. We already have orders, maybe deliveries will start even this year." Baltika will also sell Baltika No.0, its alcohol-free beer, for the local Iraqi population. The United States -- Baltika's biggest market -- should consume 1.5 million litres this year and double that next year. "China should show a similar result next year," Kistev said. Brazil will drink 360,000 litres of Baltika beer in 2005. The only market where Baltika faces major problems is ex-Soviet Georgia, whose authorities jailed the head of Baltika's local distributor for 3 months on accusations that the company had not paid excise charges. Baltika denies this. "We have been forced to stop sales to Georgia," Kistev said. Baltika used to deliver beer to Armenia via Georgia, but will now have to consider transportation through Iran, where Baltika also sells alcohol-free beer. Baltika also plans to launch production outside Russia, primarily in the CIS countries. "There are such plans and we are holding talks," he said without elaborating. Belarus: The construction of a new Belarus-Czech brewery is planned to be started in Grodno this year. This event will increase several times the Belarus demand for brewing barley. The joint Belarus-Czech enterprise OOO “Kuntzevsky pivovar, 1877” has already been registered. The owners of the new company are Belarus company Conversion-Invest, which owns 60%; Czech company Aragast with 31% and Grodno Brewery with 9%. The project, which includes construction of the plant and modernization, requires EUR 11.5 million. The production capacity of the new brewery will come to 20 million litres of beer per annum. According to analysts 40% of the production is planned to be sold on internal market the rest is to be shipped abroad. The enterprise is to start brewing on January 1, 2006. Malt News Ukraine: The European Bank for Reconstruction and Development (EBRD) signed on October 21 an agreement with Soufflet Group about purchasing 24% shares of the largest Ukrainian malt producer OAO Slavutsky Malting Plant based in Khmelnitski Oblast. More over EBRD is offering a five-year credit of USD 11.8 million for financing the expanding of company’s production capacity up to 150 thousand tonnes of malt per year. The financing will also be invested in implementation of international quality certification, application of energy-saving technologies and management improvement. The loan was offered in the network of earlier concluded contract with Soufflet Group for EUR 65 million to support the company’s activity in Central and Eastern Europe. The share holding was acquired from the French company Soufflet, which was controlling 90% of the Slavutsky’s shares before the deal. On 8 March 2004 Baltic Beverage Holding (BBH) sold 90% of company‘s shares to Soufflet Group. Representatives of Souffle Group pointed out that the granted credit funds would help to create stable source of revenue for farmers. Having great experience in malt production Souffle Group will provide assistance in establishing new technologies of barley growing and culturing. Slavutsky Malting plant output in the last three months about 6 thousand tonnes of malt. In September the plant produced 1.6 thousand tonnes of malt that is a 75% drop versus August. Its production facilities are calculated upon yearly 120,000 tonnes barley processing and 70,000 tonnes malt output. Reportedly, the Soufflet group, the world's leading maltster, has invested in Central Europe, which began at the end of 1998. Malteries Soufflet produces in nine countries, France, Poland, the Czech Republic, Hungary, Romania, Russia, Kazakhstan, Ukraine and Serbia-Montenegro. It owns 22 malting plants with 686 thousand tonnes production capacity per year in France and 600 thousand tonnes in Eastern Europe countries. With Slavutsky plant the total production capacity of the plant comes to 1.3 million tonnes. According to analysts Ukraine’s demand in malt is 120 thousand tonnes per year. EU: The EU malting industry was expected to be in deep trouble because of extremely low sales prices for 2005 and the added malt capacities in the EU, Russia and Ukraine, industry analysts posted in a statement. In the first half of 2004 exports went well, and most maltsters report small malt stocks to-date. Barley markets dropped to levels, which reduced or even abolished foreseen financial losses. As beer sales look very good in Southeast Asia and South America, the situation of the EU malting industry looks more optimistic. “But is the major crisis only postponed?” Barley News

World barley markets were a little firmer in September, mainly because of some tightening of Black Sea supplies, according to International Grains Council Report posted by the end of September. Larger crops in Europe and the CIS are expected to lift world barley production in 2004 by about 9 million tonnes, to 149 million tonnes. The EU estimate is raised by 1 million tonnes from last month due to higher than expected yields in France and Germany, but forecasts for Australia and Canada have been cut, leaving the global estimate virtually unchanged. In contrast to maize, the Council’s forecast of world consumption of barley has been trimmed by 1m. tons, to 143m., a figure lower than last year because of reduced feed use in the EU, which had been unusually large in 2003/04 due to reduced wheat and maize supplies. In Ukraine, where barley is the biggest single feed grain, consumption has been affected by the slow recovery in the livestock sector, especially cattle and pigs, after last year’s sharp fall in feed supplies, and forecast use of this grain has been lowered accordingly. Trade prospects for barley have not changed significantly since last month, with only a modest upturn expected, mainly in the malting sector, as shipments to China recover. Because of uncompetitive prices compared with Black Sea and other offers, EU feed barley exports are forecast to be very small in 2004/05. Following a significant increase in the forecast for the EU, world barley stocks are placed 1m. tons higher than before and are expected to rebound to a six-year high of over 28 million tonnes.

According to International Grains Council (IGC) on August 26 Tunisia bought 0.1 million tonnes of Black Sea feed barley. On September 22 Jordan bought 0.1 million tonnes of feed barley.

* - 70/30 = 70% Average two Rows Spring and 30% Six Rows Winter ** - 50/50 = 50% Average two Rows Spring and 50% Six Rows Winter Theoretical malt prices for crop 2005 are available on site www.e-malt.com/MarketPrices Malting barley prices. French barley prices. Nominal prices.

October 2004: |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||