|

Newsletter Summary

Currency rates Brewery news Malt news Barley news More news Theoretical malt prices Malt Price Evolution Malting barley prices Table of the week Graph of the week Agenda Do you know e-malt.com?

Average market prices Change trend

Note: Just click on the price link and you will be led to our Market Price History. Average barley market prices are French and are estimated on FOB Creil basis. Average malt market prices are estimated on FOB Antwerp basis. The changes are compared to last Newsletter's prices. Arrows indicate the direction of the change.

Easy E-malt.com

E-malt.com access

Do you know

E-malt.com ?

Dear E-malt Reader!

E-malt.com Links!

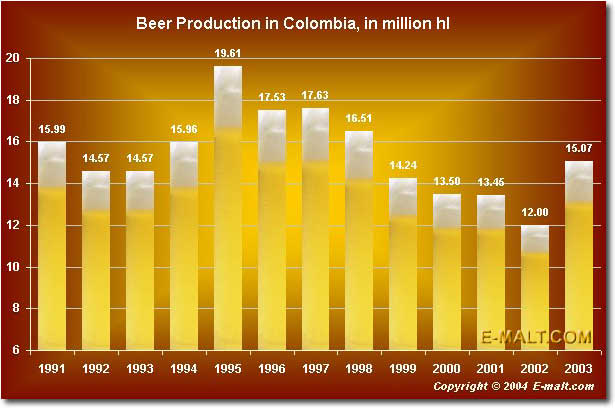

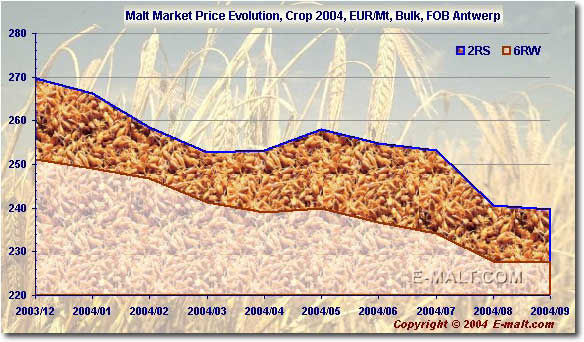

Newsletter 37b, 2004  Newsletter 37a, 2004  Newsletter 36b, 2004  Newsletter 36a, 2004  Newsletter 35b, 2004 The evolution of market prices for barley and malt, which are periodicaly issued with e-malt.com newsletters are published on e-malt.com site in Market Prices section. Just click here! Malt Market Price Evolution. Crop 2004 French Malting Barley Price Evolution. Crop 2004 Malt Market Price Evolution. Crop 2003 French Malting Barley Price Evolution. Crop 2003 All graphs issued with e-malt.com newsletters are published in "Graph" section of e-malt.com site.  Asia per capita consumption of beer in 2003  World premium beer market  Belgium beer production and export  Russian beer exports  Argentina beer consumption The graphs are updated from time to time. Just see the updates online on e-malt.com site!  Canada Domestic and Imported Beer Sales  Canada's per capita consumption of beer  Canada's Number of Breweries  Australia export of barley & malt  Canada exports of malt We have the pleasure to let you know that all e-malt.com tables are published in e-malt.com Statistics section. The Statistics section includes Barley statistics, Malt statistics and Beer statistics. The tables related to barley are published in Barley Statistics section, the tables related to malt in Malt Statistics section and the tables related to beer in Beer Statisctis section. search in statistics  EU malt export licence fixations until August 24, 2004  Ukrainian barley export  Canadian malting barley exports by countries  European barley crop estimate  The 40 beer giants of the world for 2003 If you have any comments, questions, suggestions or remarks, you can send a mail to: info@e-malt.com. To submit your own news to our editorial team, email to: info@e-malt.com If you have received this newsletter from a colleague, you can obtain your own free subscription here, or a full FREE registration here. You may recommend our site to your friend by clicking here If you do not wish to receive our newsletter, please unsubscribe your e-mail address (@EMAILADDRESS@) from our mailing list using unsubscribe form from our site! | ||||||||||||||||||

|

E-malt.com Newsletter 38a September 13 - September 15, 2004 Currency Rates

China: Lion Nathan Limited in deal to sell Chinese beer business for $A219 million. Lion Nathan Ltd said on September 15 it has entered into an unconditional agreement to sell its Chinese beer business, Lion Nathan China, to China Resources Breweries (CRB) for $US154 million ($NZ236m). The sale follows the conclusion of a competitive sales process, ShareChat News posted on September 15, 2004.

CRB is a joint venture owned by SABMiller and China Resources Enterprises, and is the second largest brewer in China, operating more than 30 breweries in the Chinese mainland. The sale price represents a premium to the book value of Lion Nathan China of around $A120 million ($NZ129 million). The consideration comprises approximately $US71 million in cash as well as the assumption by CRB of about $US83 million in debt. Completion is expected to occur on September 30.

"This is an excellent outcome for Lion Nathan and its shareholders," said Lion Nathan chief executive officer Gordon Cairns. "It can be attributed to a number of factors including the quality of our assets and brands, the strategic importance of our operations in the rapidly consolidating Yangtze River Delta beer market and the outstanding job the Lon Nathan China team has done in building our business in China," he said.

Lion Nathan chief financial officer Jamie Tomlinson said the decision to sell the Chinese beer business followed a detailed review of Lion Nathan's competitive position in China. He said the options considered included increasing the scale of the business through acquisitions, participating in the consolidation of the Chinese beer market by way of a merger or joint venture, or selling the business into the current wave of industry consolidation.

"Having considered all of these options, Lion Nathan concluded that this sale was the best outcome for Lion Nathan shareholders especially given the capital and profit risk associated with remaining in China," he said. The proceeds of the sale will be applied to debt reduction, Tomlinson said.

Colombia: Colombian brewer Bavaria will take direct control of Compania Boliviana de Bebidas, which it already controls indirectly via its Peruvian subsidiary Cervecerias Peruanas Backus y Johnston, Bavaria said on Tuesday, Sept 14, according to Reuters. “We simply want the head office to have more direct control over the operation in Bolivia. We're going to make a bit more of an effort in marketing and publicity to beef up that operation," a Bavaria official said. Bavaria plans to spend about $4 million on marketing and refrigeration units for Compania Boliviana de Bebidas, which produces non-alcoholic drinks and shares rights to PepsiCo Inc (PEP.N: Quote, Profile, Research) products in Bolivia, the official said. Bavaria, controlled by Colombian businessman Julio Mario Santo Domingo, has recently bought breweries in Panama and Peru and has consolidated its brewing in Ecuador. It also has operations in Costa Rica. Germany: Despite searing temperatures, the German Beer market declined more sharply in 2003 than in any of the previous three years. According to a brand new report from leading beverage industry analysts Canadean, the effects of the controversial deposit scheme were dramatic. Introduced on the opening day of the year, the scheme charges consumers a deposit on all non-refillable packs and actually resulted in some retailers de-listing products from their shelves altogether. As a result, sales of canned Beer were decimated with consumption plummeting by more than 70%. The repercussions were widespread and even the Beer Mix segment, which has been expanding rapidly, took a significant downturn. The launch of the scheme could not have come at a worse time for the market, which has been in decline for a number of years. Overall, consumption dropped by more than 3% although the losses in canned Beer were partly offset by the strong growth in exports, particularly to other EU countries. Although export levels have traditionally been low when compared with domestic consumption, they are now booming. As turnover increases, German brewers are unsurprisingly showing a greater interest in these foreign markets! The largest segment, Pils, was responsible for over 90% of the total market decline. Much of this volume was lost to the third most important and fastest growing segment, namely Export (Export style beers as opposed to Exports). Second placed Weizen also grew strongly and is now enjoying something of a cult status. The on-premise channel proved especially rewarding for the segment which is moving further away from its regional roots in southern Germany to become a national and international favourite. This said, the very small number of national brands indicates that the potential for further growth may still be considerable. Between 1999 and 2002, consumption of Beer Mix Drinks grew by almost 80%. However, many products launched exclusively in cans were withdrawn from sale completely once the retailers began de-listing. The segment also faced increasing competition from flavoured alcoholic beverages. Germany remains the largest Beer market in Europe and is home to no less than three quarters of the EU's brewers. The number of breweries is expected to decline as the merger and acquisition activity seen in recent years continues apace. Looking forward, Canadean predict that the impact of the deposit scheme will be softened as more brands are marketed in refillable packs and retailers institute systems for the return of packaging. Exports should continue to thrive in 2004 but the familiar challenges presented by the shift towards healthier lifestyles, lower disposable incomes and the substitution of Beer for other beverages are likely to result in total consumption declining further still. UK: InBev is to close the Boddingtons Brewery. Workers at Boddingtons went on a wildcat strike on Tuesday afternoon (September 14) as anger mounted over controversial plans to close Manchester's historic brewery. All daytime production staff at the Strangeways plant, which has been operating since 1778, walked out just before 1pm in protest at threats to axe jobs. Earlier, officials from the T and G union met senior management figures from InBev - formerly Interbrew - the Belgium-based brewing giant that owns Boddies, which has proposed the closure. Staff hoped the meeting would produce a breakthrough and a change of heart by the company. But after two hours of talks, union representatives told the workforce that InBev was still determined to close the brewery, with the loss of 55 jobs. Angry workers then decided to walk out and stay out for 24 hours. Their action was not sanctioned by the T and G, which had not expected such a furious reaction on the shop floor. InBev announced last week that it would be shutting the Boddingtons Brewery in Manchester, home to the “Cream of Manchester” for almost 200 years. Interbrew UK, which owns the Stella Artois and Beck’s brands, said that it was planning to shift production of cask Boddingtons to the rival Hydes Brewery in Manchester under contract. Production of its non-cask ales will be moved to Preston, South Wales and Glasgow. Cask ale Boddingtons, which InBev says accounts for 10 % of business, is set to be produced at Hyde's brewery in Moss Side. The shock announcement came two years after the M.E.N, the union and the workers combined to persuade InBev to drop a similar plan. But the brewing giant says that it has now done all it can to try to keep the site open. The company says that there has been a 14.5 % drop in sales of Boddingtons cask ales in the past two years. But the T and G disputes the figures and is calling on workers in InBev plants around the world to back their campaign to stay open. Workers held an angry meeting a night before when they unanimously backed plans to oppose the closure. They argue that the brewery is performing within budgets, increasing production and is in better shape than two years ago. One of those Boddies staff present said: "This was one of the most angry meetings I have seen in many years at this place. The people here feel like they've been sold down the river and they want to take this fight to InBev at the very highest level." ...more info Brazil: Brazilian brewer Kaiser has concluded an agreement with Femsa, Mexico’s largest beverage company, to produce Sol beer in Brazil, according to Mexico press. The drink is already being manufactured in Kaiser’s factory in Araraquara city in the state of Sao Paulo, Valor Econômico reported on September 13. Citing José Antonio Fernandez, Femsa’s main executive, in the story, the newspaper said that the partnership is the first step by the Mexican company to increase its beer sales in the Latin American market. China: SABMiller, the world's second largest brewer, made the second round of bidding for Australian brewer Lion Nathan's Chinese business, The Times reported on Tuesday, September 14. The estimated 85-million-pound ($153 million) bid, reported by The Times without citing specific sources, compares with a range of analysts' expectations of A$100 million ($70 million) to A$150 million for the loss-making China operations. SABMiller, listed in both London and Johannesburg, withdrew from a bidding war for China's Harbin Brewery earlier this year, ceding the field to arch-rival Anheuser Busch. But it did not renounce its ambition to expand in China, the world's largest beer market, which is growing at about 6 percent a year. Global rivals such as Anheuser Busch, Dutch Heineken and Belgium's InBev have also been tipped as possible bidders in Lion Nathan's China auction, as have Asian groups such as China's Chongqing and Japan's Asahi, according to Reuters. Melbourne analysts said Lion Nathan would benefit from a wave of mergers among Chinese brewers as it moved closer to the sale. " "Clearly Lion Nathan is trying to strike while the iron is hot," an analyst said. Lion Nathan entered China in 1995 but its operations there have since tallied up losses of more than A$200 million, including writedowns. China is the world's largest beer market by volume but Lion Nathan has found it tough to turn a profit in the highly competitive market. Its China revenues in the six months to March 31 climbed 15.9 per cent to A$22.8 million and volumes, excluding the acquisition of the Hua Xia Brewing Co in Changzhou, were up 54 per cent to 49.6 million litres. But Lion Nathan warned increased competition and cost pressures would make it challenging to break even in operating earnings terms for the full year. The company's key brands in China are Taihushui, Steinlager, and Rheineck, targeting the Yangtze River Delta region, which includes Shanghai. Its main breweries are in Suzhou and Wuxi and it also has a smaller plant at Changzhou. Its plants had been operating at well below capacity, analysts said. Malt News Russia: In January/ June this year Russia still imported 290,000 tonnes of malt (550,000 tonnes July 2003 – June 2004). Imports of barley were 410,000 tonnes in the crop year 2003/04, which included 260,000 tonnes malting barley from the EU, according to the latest figures. Barley News

Canada: For 2004-05, barley production in Canada is forecast by Agriculture and Agri-Food Canada (AAFC) to increase by 5% due to higher yields, despite lower seeded area, AAFC posted on September 10. Due to higher carry-in stocks and production, supplies are expected to rise by 9%. Feed use is projected to increase significantly, due to higher barley supplies in western Canada and increased shipments to eastern Canada. Malting barley exports are expected to rise, as import demand from China returns to normal. Feed barley exports are forecast to fall, due to increased competition from the Black Sea region, the EU-25, and Australia. Carry-out stocks are forecast to increase significantly. Off-Board feed barley prices are expected to decrease by about $15/t from 2003-04 to $120/t, due to increased domestic barley production and depressed US corn prices. The CWB August PRO for No.1 CW Feed Barley is $116/t I/S VC/SL, versus $167/t for 2003-04. The PRO for Special Select Two Row designated barley is $181/t versus $200/t for 2003-04, mainly due to higher supplies expected in Europe and Australia.

* - 70/30 = 70% Average two Rows Spring and 30% Six Rows Winter ** - 50/50 = 50% Average two Rows Spring and 50% Six Rows Winter Theoretical malt prices for crop 2003 are not quoted. Malt Price Evolution

Malting barley prices. French barley prices. Nominal prices.

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||